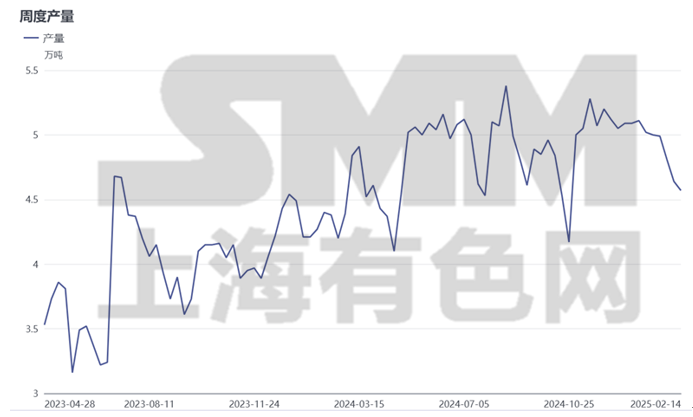

SMM, February 19: Recently, silicone monomer producers have increased maintenance activities, strengthening the support for DMC prices compared to earlier periods. According to SMM statistics, a total of 1.82 million mt of monomer capacity in China is currently under maintenance. In March, some monomer producers are expected to continue maintenance plans, leading to significant reductions on the supply side. With the arrival of the peak demand season, silicone DMC supply is expected to remain tight.

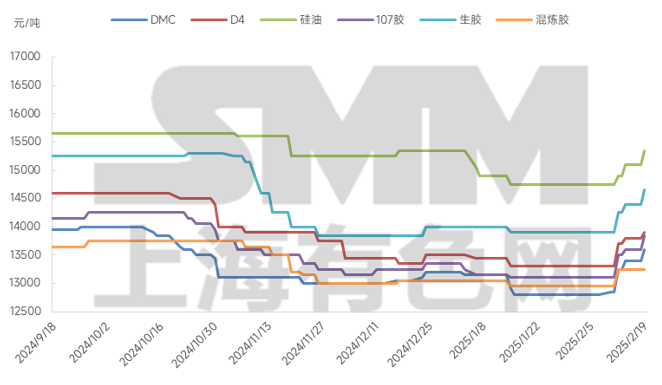

Chart: Silicone Product Price Trends

This week, domestic monomer producers saw another increase in DMC prices. Although quoted prices have not been adjusted, actual transaction prices rose due to joint efforts to refrain from price cuts by producers. According to SMM, this week, silicone DMC transaction prices increased to 13,400-13,500 yuan/mt, up by approximately 500 yuan/mt WoW. SMM attributes the upward shift in transaction price center to the consistent price-supporting sentiment among monomer producers, with no quotes below 13,400 yuan/mt and no acceptance of price negotiations. As most downstream enterprises resumed operations and sought to hedge against potential price increases for silicone raw materials during the peak season, market trading volume began to rise, accepting monomer producers' quotes, which further pushed up the transaction price center. Additionally, recent reductions in operating rates among monomer producers have brought the industry's maintenance capacity close to 2 million mt/year. Some producers are concerned about potential supply shortages, supporting the upward trend in silicone product prices, primarily DMC.

Chart: Weekly Production Trends of Silicone DMC

Supply side, the number of monomer producers undergoing maintenance is relatively high this time. Although some maintenance schedules align with annual maintenance periods, joint production cuts remain the primary driver of this round of maintenance. According to SMM statistics, monomer producers in south China, north China, central China, and east China are all undergoing maintenance, with a relay effect observed. From February to mid-April, domestic monomer producers are expected to maintain relatively low operating rates, with peak maintenance capacity reaching 2 million mt/year, enhancing expectations for supply-side improvement.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)